How To Budget Your Money The Right Way (And Retire In Less Than 10 Years) Using The 50/30/20 Rule

Aug 17, 2022

Currently, 64% of Americans are living paycheck to paycheck and 48% of those making $100,000 a year are also living paycheck to paycheck

In my own personal journey of living paycheck to paycheck to eventually purchasing over 20 rental properties, building passive income, and creating financial freedom, I've found that more important than HOW MUCH YOU MAKE is HOW MUCH YOU SPEND.

There have been times in my life where I've made $19k a year but managed to save $9k of it...

and there have been years I made much more and didn't save money.

If you don't have a specific plan for where every dollar is going to go, you will end up with more month at the end of the money.

As the saying goes "those who fail to plan, plan to fail"

What is a budget? A budget is a plan for every dollar that you have.

Let's discuss the PERFECT way to manage and budget your money (and retire in less than 10 years) using a strategy called the 50/30/20 rule that divides our money between NEEDS , WANTS, and SAVINGS

I'll then breakdown some adjustments you can make so you can retire much faster- in about 10 years (more on that below)

OVERVIEW

After calculating your take home pay, here is how your money should be divided up

- 50% goes towards NEEDS

- 30% goes towards WANTS

- 20% goes towards MONEY GOALS (SAVINGS, DEBT PAYOFF, INVESTING)

Now that we know the general breakdown, let's go deeper into each category.

50% NEEDS

50% of your take home pay should go towards NEEDS.

Your needs are things that are essential for survival and living.

Here is how i recommend breaking it up

- Rent / Mortgage = 25-33% of your take home pay (I recommend 20-25%)

- Food = 10-15% (if you are making $50,000 a year it would be $5000-$7500 / year)

- Transportation = 15% (this should include ALL car / vehicle related expenses such as payments, insurance, gas, maintenance, etc

- Utilities = 3%

- Health Insurance / Insurance = 5%

NOTES:

- Keep in mind this will look a little different for each individual person but this is a good starting place.

- Someone who makes a really high income may not need to spend 10-15% on food. The key is to try and stick as close to these ranges as possible

- You can also change the percentages of each item in the needs according to your preferences and lifestyle / situation

CUTTING BACK

If you aren't able to meet these ranges, I highly suggest you first focus on ways of cutting back.

For most people they will get the most benefit focusing on the two largest areas of expenses which are housing and food.

Cutting Cost Of Housing:

- rent out a room

- get a roommate

- downsize apartment or house

- move in with parents

- move to a cheaper part of town

Cutting Cost Of Food:

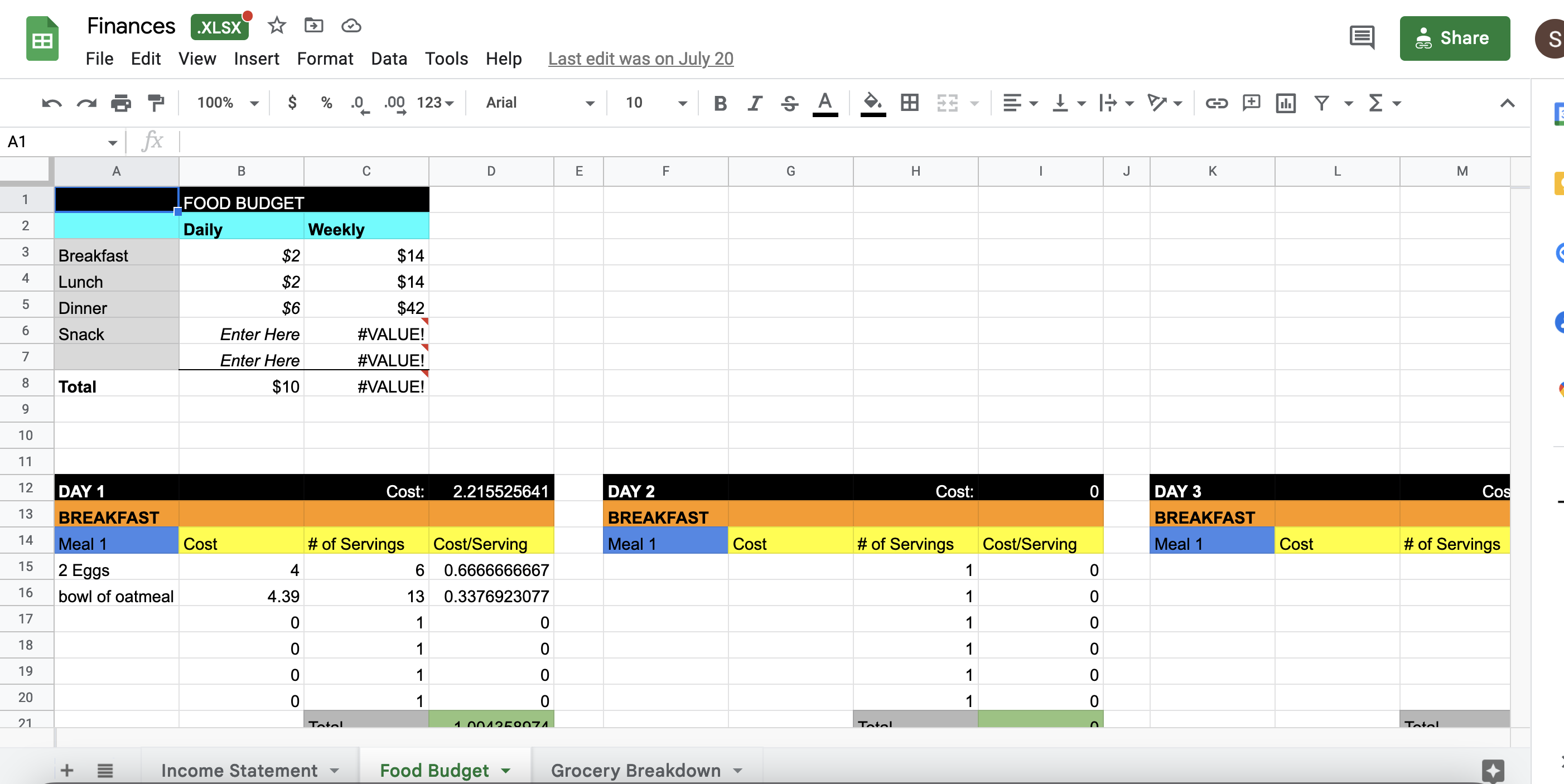

One of the best ways to hit your food target goal is to work backwards.

Let's say you determine you want to spend $5,000 per year on food.

First, break it down by week

$5,000 / 52 weeks = $96 / week

Next, break it down by cost per day

$96 / 7 days = $13.71 (let's call it $14)

Then, break it down to cost per meal. This can be divided up however you want.

For me, I chose to spend $5 a day and I broke it down like this.

- $1 for breakfast

- $1-2 for lunch

- $2-3 for dinner

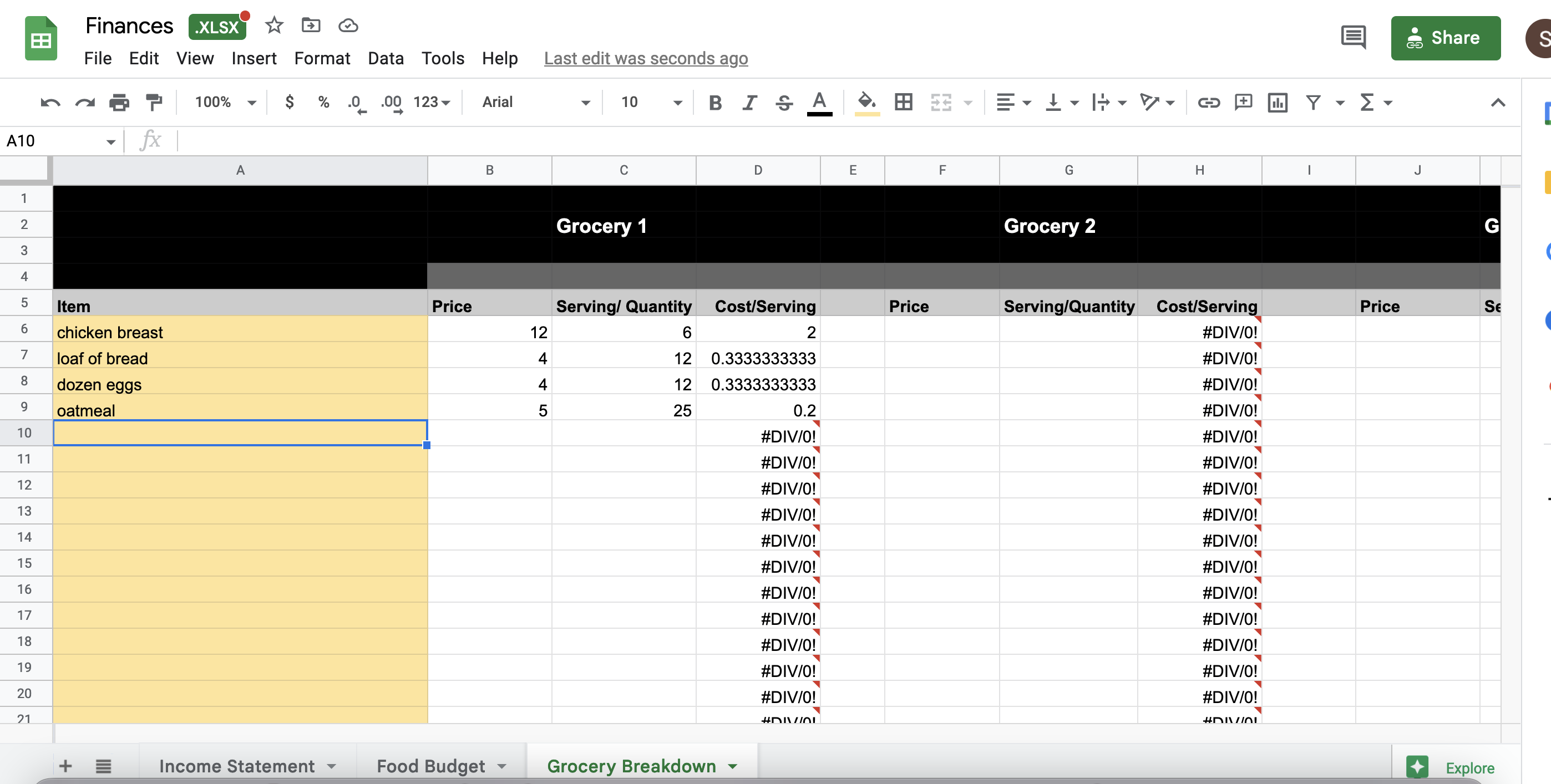

To do this, I created an excel spreadsheet that listed all the foods I frequently bought, how much the item cost, and how many servings i'd get, so i could understand the cost per serving.

From there I would simply create combos that fit my budget.

What I've found that is that more specific you get with your goals, the easier it is to achieve them.

30% WANTS

Wants are your lifestyle choices.

They are the things that you don't have to have, but they make your life easier.

Depending on who you talk to there can be some dispute on what is considered a NEED vs a WANT, but as long as it fits into these categories.... does it really matter?

Examples of wants

- clothes

- entertainment

- travel

- eating out

- streamers (netflix, hulu, hbo, disney+, etc)

- gym membership

- cell phone (though a need, you may not NEED the highest data package)

Remember, this budget isn't saying you can't have these items, but you shouldn't spend more than 30% of your take home pay in these categories.

Find which matter most to you and enjoy them to the fullest.

20% SAVINGS

The remaining 20% of your take home pay should go towards money goals which includes savings, debt payoff, and investing.

This is where your wealth building and financial freedom is made.

STEP 1: PAYOFF DEBTS

If you have any high interest debts, interest rates higher than 5-6%, then I suggest putting your 20% towards debt payoff.

You can use strategies such as the debt snowball or avalanche effect

STEP 2: SAVINGS

Once you have your high interest debts paid off, next you'll want to create a 3-6 month emergency fund. This will be used in the event of emergencies such as a car breakdown, sudden job loss, refrigerator going out, etc.

STEP 3: INVESTING

Once you have high interest debts paid off and your 3-6 month emergency fund, next you'll want to put your money into investments.

While I won't be getting into details of what to invest in (please see my youtube videos for ideas on investments)

Where to start looking for investments

- Index Funds (beat out hedge funds and individual stock pickers 92-96% of the time over a 15+ year period of time)

- ETFs

- Real Estate

- REITs

THE BIGGEST ISSUE I HAVE WITH THE 50/30/20 RULE

While I do like the 50/30/20 rule overall, there is one major thing I have a problem with.....

and that is how quickly you will be able to retire following this strategy.

If you only save 20% of your income and invest it earning a 5% annual rate of return, it will take you 37 years before you can retire off your investment income.

I don't know about you but I want to retire much quicker than 37 years.

50/10/40 RULE (OPTIMIZED FOR FAST RETIREMENT VERSION)

If you are someone like me who wants to retire faster than 37 years using the 50/30/20 Rule you may want to look at the 50/10/40 rule.

In this rule:

- 50% = NEEDS

- 10% = WANTS

- 40% = MONEY GOALS (SAVINGS , DEBT PAYOFF , INVESTING)

When you invest 40% of your income and get a 5% annual rate of return you will be able to retire in just over 20 years.

WANT TO RETIRE FASTER THAN 20 YEARS?....

Invest 60% of your income while earning 5% annual rate of return and you can retire in about 12 years

Here's a really awesome retirement calculator that let's you see how quickly you can retire based on your savings rate

CONCLUSION

There you have it, this is the perfect way to budget your money to finally start saving money and working towards your retirement.

IF you enjoyed this content, make sure to subscribe to my youtube channel. Each week I post videos on how to go from where you are to where you want to be financially - personal finance, entrepreneurship, income magnification, investing, passive income, and wealth building.

Want to learn how to create the breakthroughs needed to go from where you are to where you want to be in the areas that matter most to you: finance, fitness, mission/purpose , relationships, life etc?

Be sure to download my FREE coaching guides so you can master the science of achievement and the art of fulfillment here

Let's build that dream!

Shaun

Join Our Mailing List

Subscribe to our newsletter to receive the latest news and updates straight to your inbox

We hate SPAM. We will never sell your information, for any reason.