How Global Liquidity is About to Change Everything for Small Business Owners and Employees

May 08, 2025

How Global Liquidity is About to Change Everything for Small Business Owners and Employees

If you’re a small business owner or an employee, you’ve likely felt the weight of recent financial pressures. Business has slowed, costs have increased, and the news is filled with talk about tariffs, wars, supply chain disruptions, and inflation. The uncertainty can feel overwhelming, and it’s easy to get discouraged.

But here’s the good news: global liquidity is rising—and fast.

Understanding the impact of rising liquidity can unlock new opportunities for you, whether you’re in business or working for someone else. So, let’s break it down.

The Role of Liquidity in Economic Growth

Liquidity—the amount of money circulating in the financial system—is one of the key drivers behind asset price movements and economic growth. Essentially, liquidity is what allows businesses and markets to function smoothly. When liquidity is rising, it makes capital more accessible for businesses, and it provides the fuel for economic growth.

As liquidity increases, certain assets will start to appreciate, and this can lead to higher revenues for businesses, which in turn leads to increased consumer spending. Let’s break down what this means for the economy:

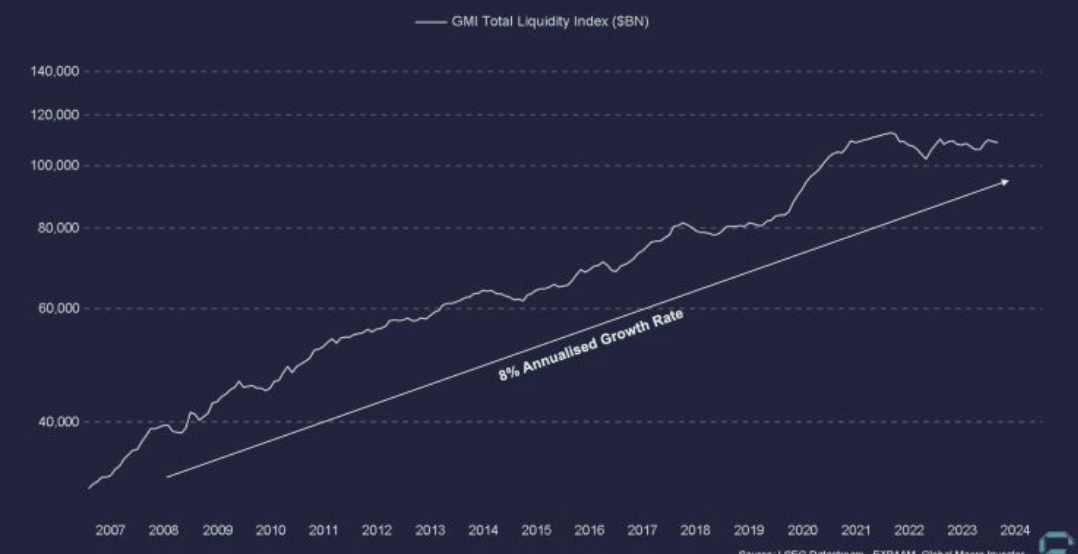

Photo 1: Annualized 8% Liquidity Injection Since 2007

This chart illustrates the annualized 8% increase in liquidity injections since 2007, helping explain the constant upward trend in asset prices over time.)

Gold’s Early Response to Liquidity Injections

One of the first assets to respond to rising liquidity is gold. Historically, gold has been the fastest to react when liquidity is injected into the market. This is because investors tend to flock to gold during periods of financial uncertainty. Right now, we are already seeing gold’s growth as liquidity starts rising.

As liquidity continues to rise, other assets, like tech stocks and crypto, will follow. These are typically the next sectors to experience a surge, as capital begins to flow into higher-growth industries.

Tech, Crypto, and Other Asset Classes

Once gold has had its move, tech stocks and crypto—which are highly sensitive to liquidity—tend to rise. And after that, we’ll begin to see more cyclical assets like real estate, bonds, and derivatives benefiting from the expanding liquidity.

Here’s what we can expect:

-

Gold: The first to react, a safe-haven asset in uncertain times.

-

Tech & Crypto: As liquidity rises, these sectors will benefit from increased capital flows.

-

Cyclical Assets (Real Estate, Bonds, Derivatives): These assets tend to see a surge as liquidity continues to grow, leading to price appreciation in real estate and traditional investments.

Photo 2: Global M2 Chart Since 2014

This chart highlights periods of liquidity contraction followed by explosive growth. You’ll notice that these contractions typically occur before a sharp rise in asset prices, such as the current market setup.)

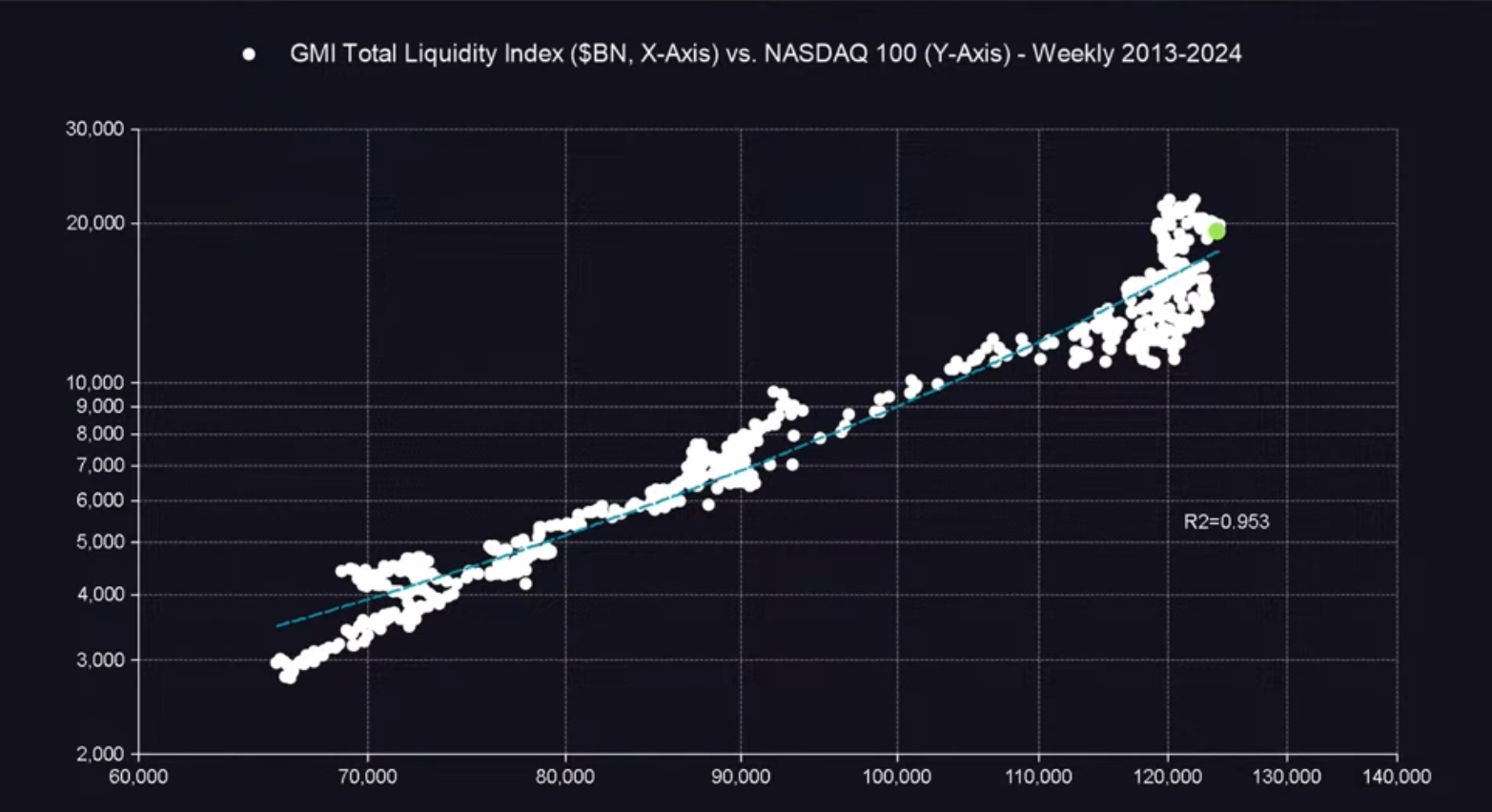

NASDAQ and S&P 500 Correlation to Liquidity

Did you know that major indices like the NASDAQ and S&P 500 are strongly correlated with global liquidity? In fact, the NASDAQ is about 94% correlated to liquidity, and the S&P 500 has an even stronger 97% correlation.

This means that as liquidity grows, these indices will see corresponding growth. Simply put, global liquidity directly impacts the performance of the stock market, which leads to more wealth creation for individuals and businesses.

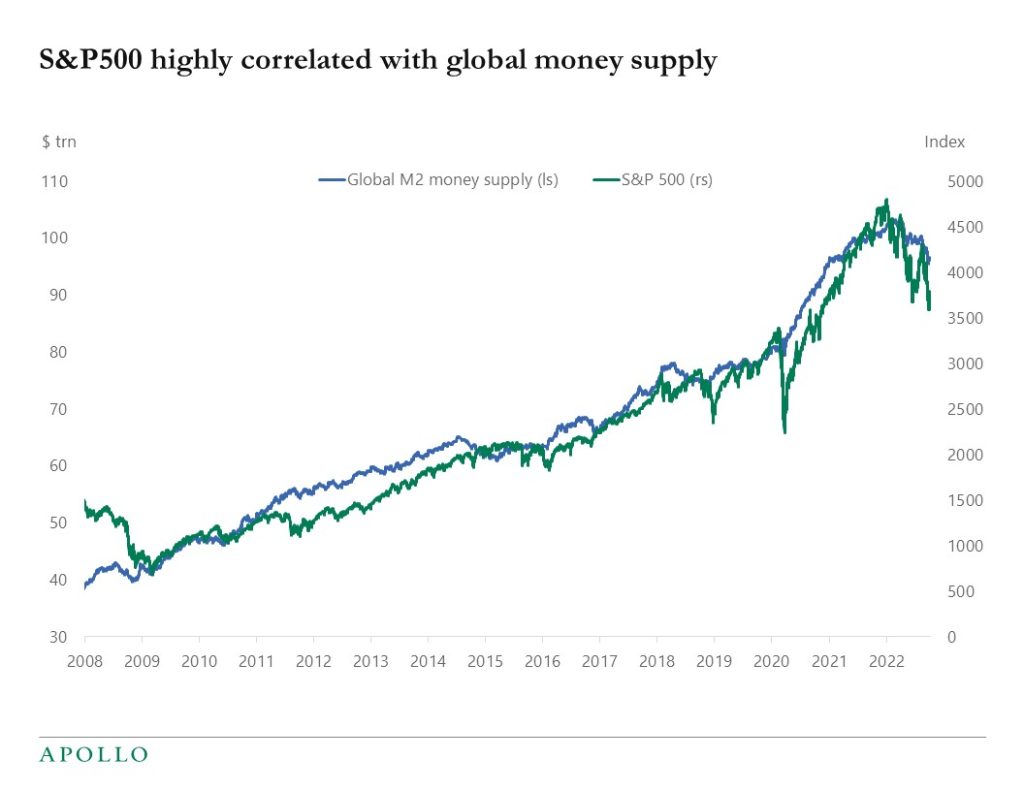

Photo 3: Correlation of Global Liquidity with S&P 500

(This chart illustrates the strong correlation between global liquidity and the performance of the S&P 500 over time, reinforcing the idea that liquidity is the key driver behind stock market movements.)

Photo 4: Correlation of Global Liquidity with NASDAQ

(Insert Photo 4 here: Similar to the previous chart, this shows the correlation between global liquidity and the NASDAQ, further supporting the connection between liquidity and asset performance, especially in tech stocks.)

The Silent Tax: Currency Debasement

While rising liquidity is a positive factor, it also comes with an underlying challenge: currency debasement. Over time, the value of the U.S. dollar and other fiat currencies lose purchasing power because of the continuous liquidity injections required to keep the financial system functioning.

On average, we’re seeing 8% more liquidity injected into the economy every year. But global inflation is around 3%, which means that we are all getting about 11% poorer every single year—even if we aren’t directly feeling the effects immediately. This is the silent tax—the erosion of your purchasing power.

Unless your business is growing by 11% per year or your job is giving you 11% raises every year (which, let’s be real, isn’t happening for most people), you’re likely falling behind.

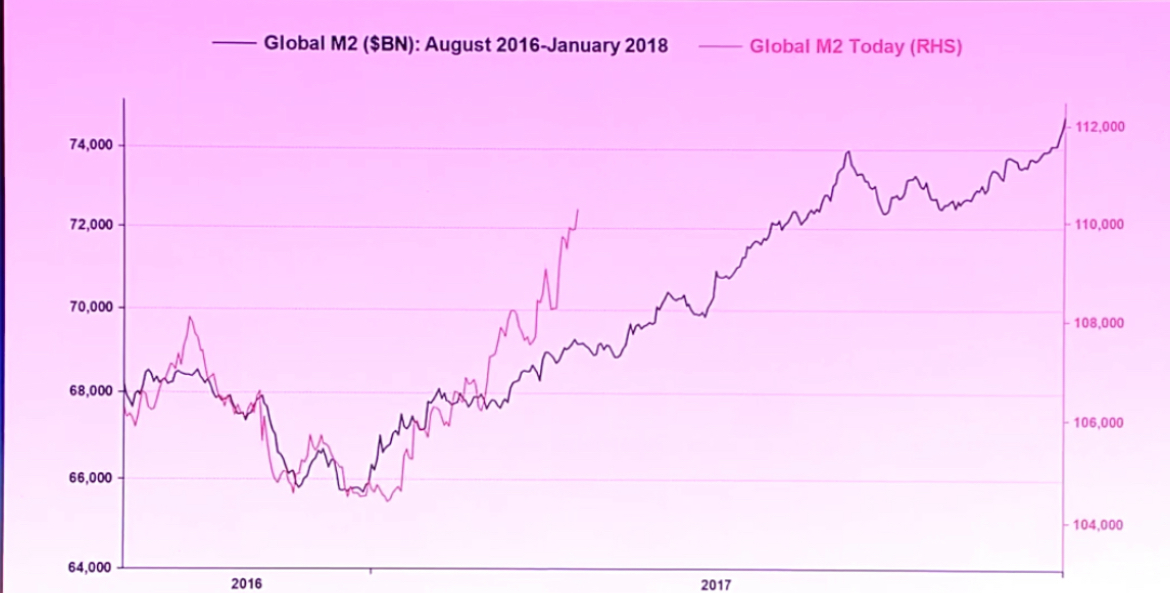

Photo 5: Global M2 Today vs. 2016-2018 Setup

(This chart shows the global M2 setup today compared to 2016-2018, with a similar macro outlook. Back then, markets dropped due to a high dollar index and tariff fears. But once liquidity expanded and rates dropped, the markets had a phenomenal year in 2017. This historical parallel shows us that we can expect a similar recovery in 2023-2024.)

How to Navigate the Coming Changes

Now, let’s talk about what you need to do to thrive in this changing environment.

1. Increase Your Income and Skills

The most crucial thing right now is to focus on acquiring valuable skills that are in demand. This could mean getting certifications, learning new skills, or even starting a side hustle. Your first mission is to increase your income as much as possible.

If you're a business owner, think about new ways to create impact. Innovate and explore alternative ways to monetize your skills or services.

2. Keep Your Costs Low

One of the best ways to stay afloat is to keep costs low. Focus on running a lean business, saving as much as possible, and protecting your cash flow. The more efficient you are, the better positioned you’ll be when the economy starts to rebound.

3. Invest Wisely to Grow Your Wealth

At this point, you need to invest. To keep up with inflation and the silent tax of currency debasement, you’ll need to earn at least 11% per year on your investments. The good news is, there are plenty of ways to do this.

If you’re new to investing, start with index funds like the S&P 500 and NASDAQ. These are passive, low-risk ways to begin growing your wealth. As you become more confident, you can explore other higher-return investments like real estate, stocks, or crypto.

Looking Ahead: Better Days Are Coming

We’re all facing challenges right now, but the road ahead holds incredible opportunity. Liquidity is rising, and as it does, we’ll see a rebound in business revenues, consumer spending, and asset prices. But it’s important to act now—increase your skills, manage costs, and start investing to secure your future.

Better days are coming, and with the right strategies, you’ll be in a strong position to take advantage of the growth that’s on the horizon.

Conclusion:

I’ve spent over 10 years as a coach, helping thousands of individuals—from Fortune 500 executives to small business owners—navigate the complexities of finance, investment, and personal growth. With a background in biochemistry, psychology, and nutritional science, I’ve built a career helping people achieve financial freedom, better health, and a balanced life.

Whether you’re looking to optimize your personal finances, build wealth through strategic investments, or transform your business with a strong financial foundation, I’m here to guide you every step of the way.

If you’re ready to take control of your financial future and leverage rising liquidity to your advantage, I’d love to connect with you. Here’s how we can get started:

Call to Action:

-

Access My Free Resources Vault: Start learning today with a variety of resources designed to help you make informed financial and investment decisions. Explore the Free Resources Vault.

-

Book a Free Value Call: Ready to dive deeper into your financial situation? Let’s schedule a value call to explore how you can grow your wealth, navigate the current financial landscape, and make smarter investment choices. Book a Call with Me.

-

Visit My Website: For more information about how I can help you with business and financial growth, check out my full range of services and resources. Visit Shaun Surgener Coaching.

Join Our Mailing List

Subscribe to our newsletter to receive the latest news and updates straight to your inbox

We hate SPAM. We will never sell your information, for any reason.